Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

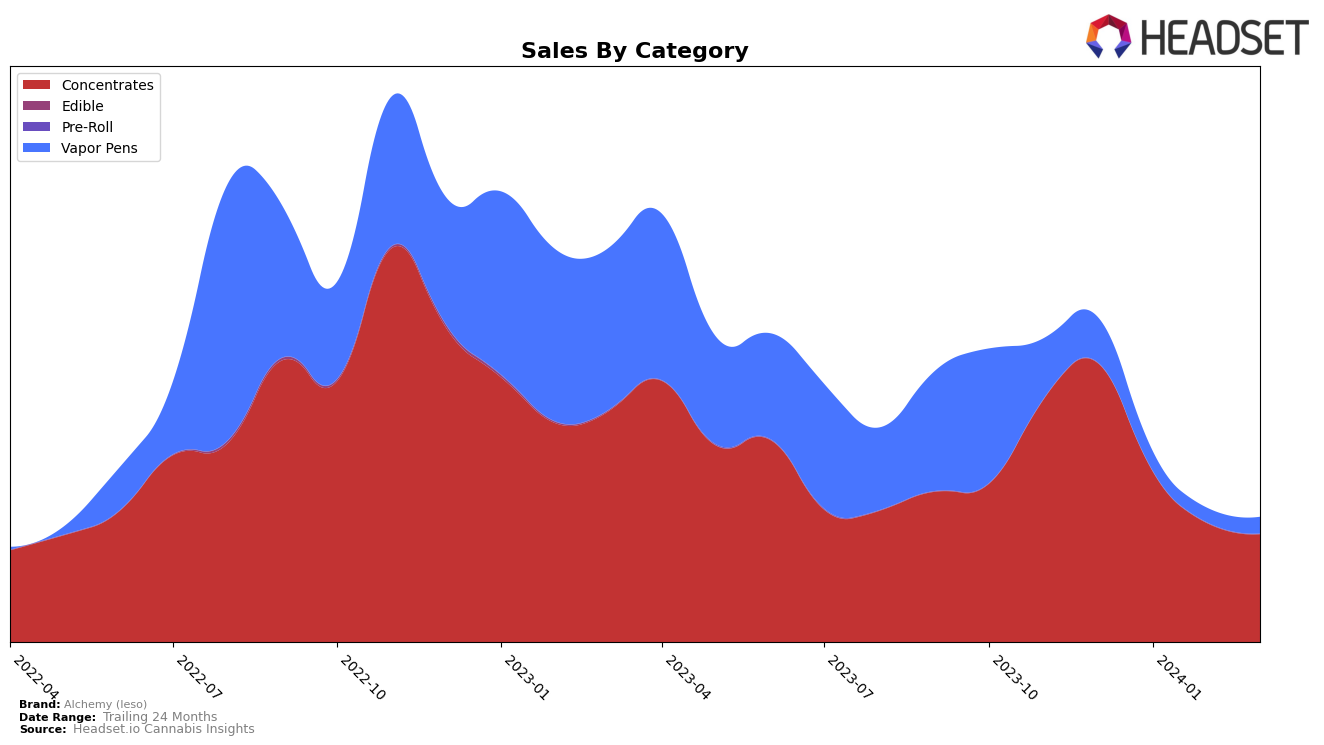

In the Illinois market, Alchemy (Ieso) has shown a varied performance across different cannabis product categories, indicating a nuanced position within the state's cannabis industry. In the Concentrates category, Alchemy (Ieso) maintained a strong presence within the top 10, albeit with a gradual decline from the 3rd position in December 2023 to the 9th by March 2024. This downward trend, mirrored in their sales figures which dropped from $739,263 in December 2023 to $285,534 in March 2024, suggests a need for strategic adjustments to regain or maintain their market share. Conversely, their performance in the Vapor Pens category illustrates a more challenging scenario. Initially not ranking within the top 30 brands in December 2023, and reaching a rank of 50 by March 2024, highlights a significant struggle in penetrating this particular market segment within Illinois, despite an increase in sales from $37,982 in February 2024 to $43,203 in March 2024.

The contrasting trajectories in these two categories underscore the complexity of Alchemy (Ieso)'s market dynamics within Illinois. The steady ranking within the top 10 for Concentrates, even amid declining sales, suggests a resilient brand presence that could potentially be leveraged with targeted marketing and product development efforts. On the other hand, the struggle to climb the rankings in the Vapor Pens category, despite not being in the top 30 initially and only making it to the 50th rank by March 2024, indicates a significant area for improvement or a possible strategic pivot. This stark difference in category performance highlights the importance of a diversified strategy that can adapt to the strengths and weaknesses within each product segment to optimize Alchemy (Ieso)'s overall market positioning and growth potential in Illinois.

Competitive Landscape

In the competitive landscape of the concentrates category in Illinois, Alchemy (Ieso) has experienced notable shifts in its market position, affecting its rank and sales trajectory over recent months. Initially holding a strong third position in December 2023, Alchemy (Ieso) saw a gradual decline in rank, moving to sixth in January 2024, eighth in February, and finally ninth in March 2024. This descent is mirrored by a significant drop in sales from December to March. Competitors such as Verano, maintaining a steady presence in the top 10, and High Supply / Supply, which improved its rank to seventh by March, highlight the dynamic nature of the market. Notably, Rythm and Shelby County Community Services also showed fluctuations in their rankings, but both managed to secure positions within the top 11 by March 2024, indicating a competitive but volatile market environment that Alchemy (Ieso) is navigating.

Notable Products

In March 2024, Alchemy (Ieso) saw John Doe Cured Resin Budder (1g) as its top-selling product in the Concentrates category, with sales reaching 2344 units, marking it as the most popular choice among consumers. Following closely, Monkey Business Cured Resin (1g) secured the second rank, moving up from the third position in February, showcasing a significant increase in demand with 1641 units sold. Peyote Cookies Cured Resin (1g) emerged as the third favorite, a notable entry given its absence in the top rankings in the previous months. Lime Skunk Muffins Cured Resin Sugar (1g), despite leading the sales in January and February, experienced a decline, slipping to the fourth position by March with sales dropping to 659 units. This shift indicates a dynamic market preference within the Concentrates category, highlighting the fluctuating consumer interest in Alchemy (Ieso)'s offerings.

Top Selling Cannabis Brands