Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

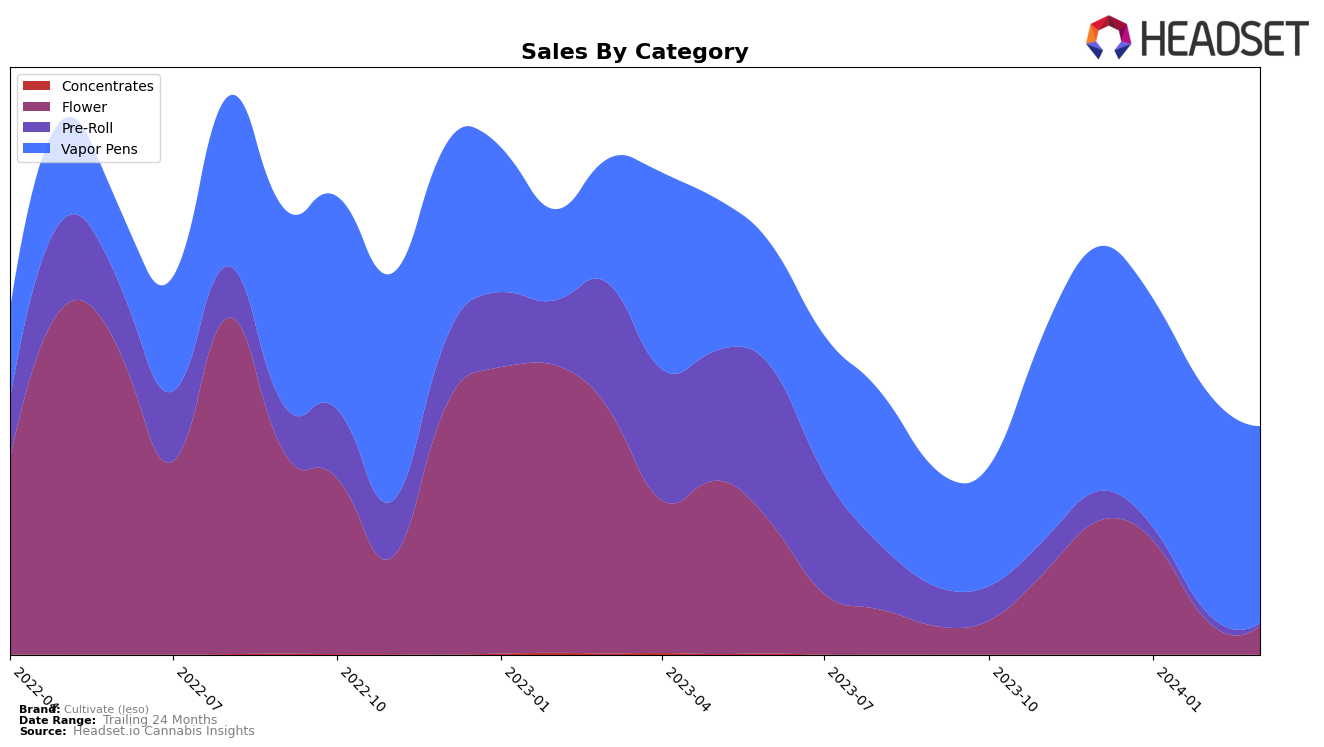

In the Illinois market, Cultivate (Ieso) has shown a varied performance across its product categories, with notable trends in both the Flower and Pre-Roll categories. For the Flower category, their ranking slipped from 37th in December 2023 to 52nd by March 2024, indicating a significant decline in their market position. This downward trend was accompanied by a decrease in sales, from $275,500 in December 2023 to $58,517 in March 2024. Similarly, the Pre-Roll category experienced a decline, with rankings falling from 37th to 59th over the same period, and sales dropping from $61,600 in December 2023 to $5,827 in March 2024. These shifts suggest a challenging competitive landscape for Cultivate (Ieso) in these categories, highlighting the need for strategic adjustments to regain market share.

Conversely, Cultivate (Ieso)'s performance in the Vapor Pens category within Illinois tells a more positive story. Maintaining a steady rank of 19th in December 2023 and January 2024, and slightly adjusting to 23rd in February and March 2024, indicates a relatively stable position in this category. Despite a slight decline in rankings, sales figures remained robust, with December 2023 sales at $506,070 and a slight decrease to $407,221 by March 2024. This performance contrasts sharply with the challenges faced in the Flower and Pre-Roll categories, showcasing Vapor Pens as a stronghold for Cultivate (Ieso) in the Illinois market. The resilience in this category suggests a solid consumer base and a potentially strategic focus area for the brand to leverage for growth and market penetration.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Illinois, Cultivate (Ieso) has experienced a slight fluctuation in its market position from December 2023 to March 2024, maintaining a middle-tier rank amidst its competitors. Notably, Simply Herb has shown a remarkable upward trajectory, moving from a lower rank in December 2023 to surpassing Cultivate (Ieso) by March 2024, indicating a significant increase in sales and market preference. On the other hand, Aeriz and Crystal Clear have also seen variations in their rankings, with Aeriz improving its position by March 2024, potentially impacting Cultivate (Ieso)'s market share. These shifts underscore the competitive dynamics within the Vapor Pens sector in Illinois, suggesting that Cultivate (Ieso) faces stiff competition not only in maintaining its rank but also in striving for growth amidst the evolving preferences and performances of its competitors.

Notable Products

In March 2024, Cultivate (Ieso)'s top-performing product was the CuraVape - Blue Dream Distillate Cartridge (0.5g) with sales peaking at 2187 units, marking its position as the leading product in the Vapor Pens category. Following closely was the CuraVape - Cherry Pie Distillate Cartridge (0.5g), securing the second rank with a noticeable performance but lower sales figures compared to the Blue Dream variant. The third spot was taken by the CuraVape - Outer Space Distillate Cartridge (0.5g), showing a significant improvement in its ranking from the previous months, moving up from the fourth position in February 2024. The CuraVape - Super Lemon Haze Distillate Cartridge (0.5g) climbed to the fourth rank, despite not being ranked in January 2024, showcasing a remarkable recovery. Lastly, the CuraVape - Hippie Crasher Distillate Cartridge (0.5g) rounded out the top five, demonstrating consistent performance by maintaining its rank from February to March 2024.

Top Selling Cannabis Brands