IESO 2009 Annual Report - Independent Electricity System Operator

IESO 2009 Annual Report - Independent Electricity System Operator

IESO 2009 Annual Report - Independent Electricity System Operator

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2009</strong> <strong>Annual</strong> <strong>Report</strong>

Table of Contents<br />

Letter to the Minister of Energy and Infrastructure....................................1<br />

<strong>IESO</strong> Accomplishments.........................................................................2<br />

Management <strong>Report</strong>..............................................................................5<br />

Auditors’ <strong>Report</strong>....................................................................................6<br />

Statement of Operations, Comprehensive Loss and Accumulated<br />

Deficit..................................................................................................7<br />

Statement of Financial Position..............................................................8<br />

Statement of Cash Flows........................................................................9<br />

Notes to Financial Statements..............................................................10<br />

Appendix A - <strong>IESO</strong> Organizational Charts...............................................24<br />

Appendix B - Executive Compensation...................................................25

ieso <strong>2009</strong> ANNUAL REPORT<br />

Letter to the Minister of Energy and Infrastructure<br />

I am pleased to submit the <strong>2009</strong> <strong>Annual</strong> <strong>Report</strong> of the <strong>Independent</strong> <strong>Electricity</strong> <strong>System</strong> <strong>Operator</strong> (<strong>IESO</strong>).<br />

Throughout the year, the <strong>IESO</strong> reliably operated Ontario’s power system and efficiently managed the<br />

wholesale electricity market in the midst of sector-wide change and evolution. The <strong>IESO</strong> aggressively<br />

managed its finances in <strong>2009</strong>, reducing costs by 6.8 per cent while simultaneously maintaining the high<br />

level of service that customers and stakeholders expect. We plan no increase in our fee for 2010.<br />

The introduction of the Green Energy and Green Economy Act, <strong>2009</strong> has had considerable impact on the<br />

company and its operations, and the <strong>IESO</strong> has revised its organizational structure to ensure it can deliver<br />

on its core responsibilities in the changing electricity sector.<br />

Engagement with customers and stakeholders remains a priority for the <strong>IESO</strong>. Survey results show<br />

the company continues to be viewed by customers and stakeholders as a competent, professional and<br />

technically superior organization that serves as a trusted advisor and operator.<br />

At the foundation of the <strong>IESO</strong>’s success lie its employees. As a direct result of their diligence and<br />

expertise, the <strong>IESO</strong> is well positioned to play an essential coordinating role in the evolution of reliable,<br />

sustainable and competitively priced electricity in Ontario.<br />

Paul Murphy<br />

President and Chief Executive Officer<br />

1

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

<strong>IESO</strong> Accomplishments<br />

The shape of Ontario’s electricity sector is changing, as new players enter the sector, new types of<br />

generation gain traction, and new legislative frameworks facilitate the development of a more sustainable<br />

electricity system.<br />

In addition to fulfilling its primary mandate as market and system operator, the <strong>IESO</strong> is uniquely<br />

positioned to play an essential coordinating role in the evolution of reliable, sustainable and<br />

competitively priced electricity in Ontario. And while the reliable operation of Ontario’s electricity<br />

system remains the <strong>IESO</strong>’s main focus, some of the company’s processes and practices are changing as<br />

implementation of the Government of Ontario’s Green Energy and Green Economy Act, <strong>2009</strong> moves ahead.<br />

Within a very short timeframe, the Act has encouraged the development of new renewable generation<br />

resources. It is also driving the enhancement of Ontario’s transmission and distribution systems, and<br />

will lay the foundation for a smart grid in Ontario. The Act is a far-reaching piece of legislation with<br />

implications for most, if not all, departments in the <strong>IESO</strong>. Preparation for implementation of the Act, and<br />

the associated Feed-in Tariff (FIT) program required immediate attention in <strong>2009</strong>, and will continue to<br />

impact <strong>IESO</strong> operations in years to come.<br />

The <strong>IESO</strong> supported the implementation of government policy through its input into the drafting<br />

of regulations for connection assessment timelines, the recovery of costs to support government<br />

conservation and demand management programs, and the design of the FIT contracts for renewable<br />

generation. <strong>IESO</strong> contributions to the FIT contract design ensured that generators have an incentive,<br />

through market price signals, to follow dispatch instructions.<br />

The <strong>IESO</strong>’s corporate performance scorecard represents four strategic perspectives that drive the<br />

performance of the company, while the underlying measures assess progress in delivering on its mission<br />

and key corporate priorities.<br />

Reliability<br />

From a reliability perspective, the <strong>IESO</strong>’s performance in operating the system and meeting industry<br />

expectations was solid. For example, the company maintained its perfect compliance record with the<br />

North American Electric Reliability Corporation (NERC) Disturbance Control Standard, which requires<br />

the <strong>IESO</strong> to restore the supply/demand balance within 15 minutes following an unexpected loss of<br />

generation. The <strong>IESO</strong>’s reliability performance was reinforced by full compliance with NERC’s high risk<br />

factor requirements in <strong>2009</strong>.<br />

One major contributor to the <strong>IESO</strong>’s routinely high standards of performance is the ongoing training of<br />

market participants and <strong>IESO</strong> control room operators. Participants learn the importance of timely and<br />

effective communication through participation in system restoration workshops, post-incident analysis<br />

and other channels. <strong>IESO</strong> efforts to engage its interconnected neighbours in an integrated multi-regional<br />

restoration exercise paid off in <strong>2009</strong>, when a highly complex outage scenario tested participants’ readiness<br />

to respond to a widespread disturbance in system operations. Internally, ongoing training of control<br />

2

ieso <strong>2009</strong> ANNUAL REPORT<br />

room operators includes regular event reviews, opportunities to practice abnormal operating conditions<br />

through role-playing scenarios and participation in joint training workshops with market participants<br />

and representatives from neighbouring jurisdictions across North America. These efforts provide<br />

operators with the skills, expertise and tools to ensure the reliability of Ontario’s power system.<br />

Compliance with reliability standards is a requirement for operation in North America’s integrated<br />

electricity system. In November <strong>2009</strong>, auditors from the Northeast Power Coordinating Council (NPCC)<br />

evaluated the <strong>IESO</strong>’s compliance with the six reliability standards and 13 requirements in the <strong>2009</strong> NERC<br />

Compliance Monitoring and Enforcement Program (CMEP) for critical infrastructure protection (CIP).<br />

After a thorough on-site audit and evaluation, the <strong>IESO</strong> was found compliant with all relevant CIP<br />

reliability standards and requirements, and praised for the provision of supporting material that was<br />

“very well presented and very well organized.”<br />

Another <strong>IESO</strong> priority is to actively contribute to relevant regulatory proceedings in Ontario and support<br />

the development of North American reliability standards. In <strong>2009</strong>, the <strong>IESO</strong> provided meaningful<br />

contributions to a broad range of regulatory proceedings, both domestically and internationally.<br />

Customers and Stakeholders<br />

The <strong>IESO</strong> continues to be viewed by customers and stakeholders as a competent, professional<br />

and technically superior organization that serves as a trusted advisor and operator. The company<br />

is considered a leader in the electricity sector. Some 81 per cent of respondents agreed the <strong>IESO</strong>’s<br />

stakeholder engagement processes are effective in facilitating stakeholder input. Similarly, the annual<br />

Customer Satisfaction Survey revealed the <strong>IESO</strong> had achieved an average rating of 7.9 out of 10 for those<br />

questions pertaining to the value of products and services provided to market participants.<br />

In the area of process assurance, the <strong>IESO</strong> achieved superior performance levels in <strong>2009</strong>. To ensure<br />

Ontario’s electricity system and market are being managed efficiently, the <strong>IESO</strong> commissions an<br />

independent review of the operation and application of the dispatch algorithm and related dispatch<br />

processes and procedures at least once every two years. After rigorous analysis and testing of<br />

documentation, procedures and management practices, the reviewers found the <strong>IESO</strong> compliant with all<br />

associated Market Rules.<br />

The <strong>IESO</strong> is equally committed to establishing and maintaining effective controls over its settlement<br />

processes. The organization recognizes the importance of having robust controls, processes, and<br />

procedures to ensure the accurate, complete, and timely delivery of settlement statements and invoices to<br />

market participants and to ensure the confidentiality of market participant information. A biennial audit<br />

conducted by external auditors in <strong>2009</strong> found the internal controls established for the <strong>IESO</strong>’s settlement<br />

operations are suitably designed and operating effectively.<br />

3

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Effective Use of Funds<br />

The <strong>IESO</strong> has always demonstrated sound financial management practices, resulting in lower operating<br />

costs in each of the last six years. The <strong>IESO</strong> continued to demonstrate financial prudence in <strong>2009</strong> by<br />

managing costs to 6.8 per cent below approved targets while simultaneously maintaining the high<br />

level of service that customers and stakeholders expect. At the same time, the <strong>IESO</strong> introduced a new<br />

organizational structure that better positions the company to deliver on its core responsibilities in the<br />

changing electricity sector. In particular, this new structure will help the <strong>IESO</strong> respond to the demands<br />

associated with the implementation of the Green Energy and Green Economy Act, <strong>2009</strong>. As part of the <strong>IESO</strong>’s<br />

most recent rate application, the <strong>IESO</strong> committed to no increase in its fees for 2010.<br />

People<br />

Considerable progress was made in <strong>2009</strong> with respect to the development of a sustainable and engaged<br />

workforce. The <strong>IESO</strong> made a strategic commitment to reduce the environmental impacts of its operations<br />

and, in <strong>2009</strong>, applied for silver-level certification of the system control centre under the Leadership in<br />

Energy and Environmental Design (LEED) program. Some of the many initiatives undertaken by the<br />

<strong>IESO</strong> included completion of an energy audit; introduction of a recycling and composting program;<br />

conversion from chemical fertilizers to organic alternatives; installation of occupant-controlled lighting;<br />

installation of low-flow aerators and low-flush fixtures; and installation of a weather station for<br />

lawn irrigation.<br />

Like many of its counterparts in North America, the <strong>IESO</strong> is facing a number of challenges brought on, in<br />

part, by an aging workforce compounded by fierce competition for skilled employees. While the company<br />

has always been focused on recruiting, retention, development and succession planning, the Talent<br />

Management Framework introduced in 2008 brought a new rigour and focus to the process. Building<br />

on this approach, employee development remains a priority at the <strong>IESO</strong> and, in <strong>2009</strong>, the majority of<br />

employees created personal learning and development plans. These plans will help ensure employees<br />

have the necessary learning products and activities to meet personal and organizational learning<br />

objectives, as well as the skills and capabilities to help the <strong>IESO</strong> uphold its statutory responsibilities in<br />

years to come.<br />

4

ieso <strong>2009</strong> ANNUAL REPORT<br />

Management <strong>Report</strong><br />

Management’s Responsibility for Financial <strong>Report</strong>ing<br />

The accompanying financial statements of the <strong>Independent</strong> <strong>Electricity</strong> <strong>System</strong> <strong>Operator</strong> are the<br />

responsibility of management and have been prepared in accordance with accounting principles<br />

generally accepted in Canada. The significant accounting policies followed by the <strong>Independent</strong><br />

<strong>Electricity</strong> <strong>System</strong> <strong>Operator</strong> are described in the Summary of Significant Accounting Policies contained<br />

in Note 2 in the financial statements. The preparation of financial statements necessarily involves the<br />

use of estimates based on management’s judgement, particularly when transactions affecting the current<br />

accounting period cannot be finalized with certainty until future periods. The financial statements have<br />

been prepared within reasonable limits of materiality and in light of information available up to February<br />

11, 2010.<br />

Management maintained a system of internal controls designed to provide reasonable assurance<br />

that the assets were safeguarded and that reliable information was available on a timely basis. The<br />

system included formal policies and procedures and an organizational structure that provided for the<br />

appropriate delegation of authority and segregation of responsibilities.<br />

These financial statements have been examined by PricewaterhouseCoopers LLP, a firm of independent<br />

external auditors appointed by the Board of Directors. The external auditors’ responsibility is to express<br />

their opinion on whether the financial statements are fairly presented in accordance with generally<br />

accepted accounting principles in Canada. The Auditors’ <strong>Report</strong>, which follows, outlines the scope of<br />

their examination and their opinion.<br />

INDEPENDENT ELECTRICITY SYSTEM OPERATOR<br />

On behalf of management,<br />

Paul Murphy<br />

President and Chief Executive Officer<br />

Toronto, Canada<br />

March 8, 2010<br />

Ted Leonard<br />

Vice President, Finance<br />

Chief Financial Officer and Treasurer<br />

Toronto, Canada<br />

March 8, 2010<br />

5

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Auditors’ <strong>Report</strong><br />

February 11, 2010<br />

To the Board of Directors of the <strong>Independent</strong> <strong>Electricity</strong> <strong>System</strong> <strong>Operator</strong> (<strong>IESO</strong>):<br />

We have audited the statement of financial position of the <strong>IESO</strong> as at December 31, <strong>2009</strong> and the statement<br />

of operations, comprehensive loss and accumulated deficit and cash flows for the year then ended. These<br />

financial statements are the responsibility of the <strong>IESO</strong>’s management. Our responsibility is to express an<br />

opinion on these financial statements based on our audit.<br />

We conducted our audit in accordance with Canadian generally accepted auditing standards. Those<br />

standards require that we plan and perform an audit to obtain reasonable assurance whether the financial<br />

statements are free of material misstatement. An audit includes examining, on a test basis, evidence<br />

supporting the amounts and disclosures in the financial statements. An audit also includes assessing<br />

the accounting principles used and significant estimates made by management, as well as evaluating the<br />

overall financial statement presentation.<br />

In our opinion, the financial statements present fairly, in all material respects, the financial position of the<br />

<strong>IESO</strong> as at December 31, <strong>2009</strong> and the results of its operations and its cash flows for the year then ended<br />

in accordance with Canadian generally accepted accounting principles.<br />

Chartered Accountants, Licensed Public Accountants<br />

Toronto, Ontario<br />

6

ieso <strong>2009</strong> ANNUAL REPORT<br />

Statement of Operations, Comprehensive Loss and<br />

Accumulated Deficit<br />

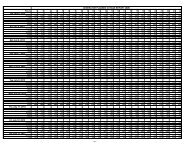

For the year ended December 31 (in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

REVENUES<br />

<strong>System</strong> fees (Note 11) 119,988 132,477<br />

Other revenue (Note 2b) 1,511 1,906<br />

TOTAL REVENUES 121,499 134,383<br />

EXPENSES<br />

Labour 74,036 76,270<br />

Computer services, support and equipment 9,275 8,988<br />

Contract services and consultants 6,860 7,500<br />

Telecommunications 2,936 2,944<br />

Other costs 7,255 6,350<br />

Smart metering program costs (Note 11) 9,962 7,763<br />

Amortization 24,319 23,360<br />

TOTAL EXPENSES 134,643 133,175<br />

Income/(loss) before interest, financial charges and investment income (13,144) 1,208<br />

Interest and investment income/(loss) 2,304 (2,321)<br />

Interest expense and financing charges (3,074) (5,945)<br />

NET LOSS FOR THE YEAR (13,914) (7,058)<br />

OTHER COMPREHENSIVE INCOME - 29<br />

COMPREHENSIVE LOSS (13,914) (7,029)<br />

ACCUMULATED SURPLUS (before change in accounting policy) - 3,014<br />

Change in accounting policy (Note 3) - (1,596)<br />

ACCUMULATED SURPLUS/(DEFICIT) - BEGINNING OF YEAR (5,611) 1,418<br />

ACCUMULATED DEFICIT - END OF YEAR (Note 11) (19,525) (5,611)<br />

See accompanying notes to Financial Statements.<br />

7

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Statement of Financial Position<br />

As at December 31 (in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

ASSETS<br />

Current assets<br />

Cash and cash equivalents 8,990 12,691<br />

Accounts receivable 13,500 13,775<br />

Prepaid expenses 3,693 3,958<br />

26,183 30,424<br />

Property and equipment (Note 4)<br />

In service 74,856 91,581<br />

Construction-in-progress 4,882 1,781<br />

79,738 93,362<br />

Other assets<br />

Intangible assets (Note 5) 6,685 6,774<br />

Long-term investments (Note 6) 18,204 14,972<br />

Prepaid pension cost (Note 7) 3,349 -<br />

28,238 21,746<br />

TOTAL ASSETS 134,159 145,532<br />

LIABILITIES<br />

Current liabilities<br />

Accounts payable and accrued liabilities (Note 8) 20,073 22,172<br />

Accrued interest on debt 66 1,030<br />

Short-term debt (Note 9) - 78,200<br />

Rebates to market participants (Note 11) 4,324 1,386<br />

24,463 102,788<br />

Long-term liabilities<br />

Long-term debt (Note 9) 78,200 -<br />

Accrued pension liability (Note 7) - 1,839<br />

Accrual for employee future benefits other than<br />

pensions (Note 7) 51,021 46,516<br />

129,221 48,355<br />

TOTAL LIABILITIES 153,684 151,143<br />

ACCUMULATED DEFICIT (Note 11) (19,525) (5,611)<br />

TOTAL LIABILITIES AND ACCUMULATED DEFICIT 134,159 145,532<br />

Commitments and contingencies (Note 13).<br />

See accompanying notes to financial statements.<br />

On behalf of the Board:<br />

8<br />

James Hinds<br />

Chair<br />

Toronto, Canada<br />

William Museler<br />

Director<br />

Toronto, Canada

ieso <strong>2009</strong> ANNUAL REPORT<br />

Statement of Cash Flows<br />

For the year ended December 31 (in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

OPERATING ACTIVITIES<br />

Net loss for the year (13,914) (7,058)<br />

Adjustments for non-cash items:<br />

Amortization 24,319 23,360<br />

Pension cost 12,524 13,456<br />

Other employee future benefits cost 6,240 6,252<br />

Change in fair value of long-term investments held for trading (1,218) 3,127<br />

27,951 39,137<br />

Changes in non-cash balances related to operations:<br />

Change in accounts payable and accrued liabilities (1,760) (636)<br />

Change in rebates to market participants 2,938 1,386<br />

Change in accounts receivable 275 55<br />

Change in prepaid expenses 265 (831)<br />

1,718 (26)<br />

Other:<br />

Contribution to pension fund (17,712) (8,646)<br />

Payment of employee future benefits (1,735) (1,673)<br />

(19,447) (10,319)<br />

Cash provided by operating activities 10,222 28,792<br />

INVESTING ACTIVITIES<br />

Net purchase of long-term investments (2,014) (1,381)<br />

Investment in property and equipment (8,975) (13,645)<br />

Investment in intangible assets (2,934) (2,304)<br />

Cash used in investing activities (13,923) (17,330)<br />

NET CHANGE IN CASH AND CASH EQUIVALENTS (3,701) 11,462<br />

CASH AND CASH EQUIVALENTS - BEGINNING OF YEAR 12,691 1,229<br />

CASH AND CASH EQUIVALENTS - END OF YEAR 8,990 12,691<br />

See accompanying notes to financial statements.<br />

Supplementary information:<br />

(in thousands of Canadian dollars)<br />

Interest paid 3,279 6,224<br />

9

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Notes to Financial Statements<br />

1. NATURE OF OPERATIONS<br />

<strong>Independent</strong> <strong>Electricity</strong> <strong>System</strong> <strong>Operator</strong> (<strong>IESO</strong>) is a not-for-profit, non-taxable corporation, created by<br />

statute effective on April 1, 1999 pursuant to Part II of the <strong>Electricity</strong> Act, 1998. As set out in the <strong>Electricity</strong><br />

Act, 1998, the <strong>IESO</strong> operates pursuant to a licence granted by the Ontario Energy Board (OEB). The<br />

objects of the <strong>IESO</strong> as contained in the <strong>Electricity</strong> Act, 1998 and amended, in the <strong>Electricity</strong> Restructuring<br />

Act, 2004 and Ontario Regulation 452/06, are as follows:<br />

• to exercise the powers and perform the duties assigned to the <strong>IESO</strong> under the <strong>Electricity</strong><br />

Restructuring Act, 2004, the market rules and its licence;<br />

• to enter into agreements with transmitters giving the <strong>IESO</strong> the authority to direct the operation of<br />

their transmission systems;<br />

• to direct the operation and maintain the reliability of the <strong>IESO</strong>-controlled grid to promote the<br />

purposes of the <strong>Electricity</strong> Restructuring Act, 2004;<br />

• to participate in the development, by any standards authority, of standards and criteria relating to the<br />

reliability of the transmission systems;<br />

• to work with the responsible authorities outside Ontario to co-ordinate the <strong>IESO</strong>’s activities with their<br />

activities;<br />

• to collect and provide information to the Ontario Power Authority (OPA) and the public relating<br />

to the current and short-term electricity needs of Ontario and the adequacy and reliability of the<br />

integrated power system to meet those needs;<br />

• to operate the <strong>IESO</strong>-administered markets to promote the purposes of the <strong>Electricity</strong> Restructuring Act,<br />

2004;<br />

• to plan, manage and implement the smart metering initiative or any aspect of the initiative;<br />

• to oversee, administer and deliver the smart metering initiative or any aspect of the initiative; and<br />

• to establish and enforce standards and criteria relating to the reliability of transmission systems.<br />

The <strong>IESO</strong> was designated the Smart Metering Entity by Ontario Regulation 393/07 under the <strong>Electricity</strong><br />

Act, 1998 on March 28, 2007. The regulation came into effect on July 26, 2007.<br />

The objects of the Smart Metering Entity, as contained in the <strong>Electricity</strong> Act, 1998, are as follows:<br />

• to plan and implement and, on an ongoing basis, oversee, administer and deliver any part of the<br />

smart metering initiative as required by regulation under this or any Act or directive made pursuant<br />

to sections 28.3 or 28.4 of the Ontario Energy Board Act, 1998, and, if so authorized, to have the<br />

exclusive authority to conduct these activities;<br />

• to collect and manage and to facilitate the collection and management of information and data and to<br />

store the information and data related to the metering of consumers’ consumption or use of electricity<br />

in Ontario, including data collected from distributors and, if so authorized, to have the exclusive<br />

authority to collect, manage and store the data;<br />

• to establish, to own or lease and to operate one or more databases to facilitate collecting, managing,<br />

storing and retrieving smart metering data;<br />

10

ieso <strong>2009</strong> ANNUAL REPORT<br />

• to provide and promote non-discriminatory access, on appropriate terms and subject to any<br />

conditions in its licence relating to the protection of privacy, by distributors, retailers, the OPA and<br />

other persons,<br />

i. to the information and data referred to above, and<br />

ii. to the telecommunication system that permits the Smart Metering Entity to transfer<br />

data about the consumption or use of electricity to and from its databases, including<br />

access to its telecommunication equipment, systems and technology and associated<br />

equipment, systems and technologies<br />

• to own or to lease and to operate equipment, systems and technology, including telecommunication<br />

equipment, systems and technology that permit the Smart Metering Entity to transfer data about the<br />

consumption or use of electricity to and from its databases, including owning, leasing or operating<br />

such equipment, systems and technology and associated equipment, systems and technologies,<br />

directly or indirectly, including through one or more subsidiaries, if the Smart Metering Entity is a<br />

corporation;<br />

• to engage in such competitive procurement activities as are necessary to fulfill its objects or business<br />

activities;<br />

• to procure, as and when necessary, meters, metering equipment, systems and technology and any<br />

associated equipment, systems and technologies on behalf of distributors, as an agent or otherwise,<br />

directly or indirectly, including through one or more subsidiaries, if the Smart Metering Entity is a<br />

corporation;<br />

• to recover, through just and reasonable rates, the costs and an appropriate return approved by the<br />

Ontario Energy Board associated with the conduct of its activities; and<br />

• to undertake any other objects that are prescribed by associated regulation.<br />

The <strong>IESO</strong> is required to submit its proposed expenditures, revenue requirements, and fees for the coming<br />

year to the OEB for review. The submission may be made only with the approval or deemed approval of<br />

the Minister of Energy and Infrastructure (Minister).<br />

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

a) Basis of financial statement preparation<br />

The accompanying financial statements have been prepared on a going concern basis and in accordance<br />

with accounting principles generally accepted in Canada.<br />

b) Revenue recognition<br />

<strong>System</strong> fees earned by the <strong>IESO</strong> are based on approved rates for each megawatt of electricity withdrawn<br />

from the <strong>IESO</strong>-controlled grid, including exports. <strong>System</strong> fees are recognized as revenue at the time the<br />

electricity is withdrawn. Rebates are recognized in the year in which the approved regulatory deferral<br />

account, before such rebates, exceeds regulated limits.<br />

These financial statements do not include the financial transactions of market participants within the<br />

<strong>IESO</strong>-administered markets.<br />

11

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Other revenue represents amounts that accrue to the <strong>IESO</strong> relating to services the <strong>IESO</strong> performs and<br />

charges on a recovery basis, investment income on funds passing through market settlement accounts, as<br />

well as fines and penalties. Such revenue is recognized as it accrues.<br />

c) Financial instruments<br />

Classification<br />

• The <strong>IESO</strong> designated its investment portfolio as being “held for trading” and classified its cash<br />

and accounts receivable as “loans and receivables”.<br />

• Cash and cash equivalents comprise cash, term deposits and other short-term, highly-rated<br />

investments with original maturity dates of less than 90 days.<br />

• Accounts payable and debt have been classified as other financial liabilities.<br />

Recognition and measurement<br />

• Held for trading investments are recorded at fair value with gains and losses recorded in the<br />

statement of operations. Transactions are recorded based on trade dates. Transaction costs are<br />

charged to operations as incurred.<br />

• Loans and receivables are initially recorded at fair value and subsequently measured at<br />

amortized cost using the effective interest rate method.<br />

• The <strong>IESO</strong>’s financial liabilities, comprising accounts payable and long-term debt are carried at<br />

amortized cost.<br />

• Foreign currency exchange forward contracts are recorded at fair value. Where foreign currency<br />

exchange forward contracts meet the criteria for hedge accounting, changes in their values are<br />

reflected in accumulated surplus as other comprehensive income. Where such contracts do<br />

not meet the criteria for hedge accounting, changes in their value are recognized in the statement<br />

of operations.<br />

d) Construction-in-progress<br />

Construction-in-progress generally relates to the costs of physical facilities, hardware and software, and<br />

includes costs paid to vendors, internal and external labour, consultants and interest related to funds<br />

borrowed to finance the project. Costs relating to construction-in-progress are transferred to property<br />

and equipment in service or intangibles when the asset under construction is deemed to be ready for use.<br />

e) Property and equipment in service<br />

Property and equipment are capitalized at cost, which comprises materials, labour, external support,<br />

overhead, and interest applicable to capital activities.<br />

f) Amortization<br />

The capital cost of property and equipment and intangible assets in service is amortized on a straightline<br />

basis over their estimated service lives.<br />

12

ieso <strong>2009</strong> ANNUAL REPORT<br />

The estimated service lives in years, from the date the assets were acquired, are:<br />

Class<br />

Estimated Average Service Life<br />

Facilities 38<br />

Meter Data Management/Repository 6<br />

Market <strong>System</strong>s and Applications 5 to 9<br />

Infrastructure and Other Assets 4 to 7<br />

Intangible Assets 4<br />

Gains and losses on sales of property and equipment are charged to operations. Losses on premature<br />

retirements for property and equipment and intangible assets are charged to operations.<br />

The estimated service lives of property and equipment and intangible assets are subject to periodic<br />

review. The impacts of changes in the estimated lives are amortized on a prospective basis. The most<br />

recent review was completed in fiscal <strong>2009</strong>.<br />

g) Intangible assets<br />

Intangible assets are capitalized at cost, which comprises materials, labour, external support, overhead,<br />

and interest applicable to capital activities.<br />

h) Pension and other post-employment benefits<br />

The <strong>IESO</strong>’s post-employment benefit programs include pension, group life insurance, health care, longterm<br />

disability and workers compensation benefits.<br />

The <strong>IESO</strong> accrues obligations under pension and other post-employment benefit (OPEB) plans and the<br />

related costs, net of plan assets. Pension and OPEB expenses and obligations are determined annually by<br />

independent actuaries using the projected benefit method and management’s best estimate of expected<br />

return on plan assets, salary escalation, retirement ages of employees, mortality and expected health-care<br />

costs. The discount rate used to value liabilities is based on market rates as at the measurement date of<br />

September 30.<br />

The expected return on plan assets is based on management’s long-term best estimate using a marketrelated<br />

value of plan assets. The market-related value of plan assets is determined using market-related<br />

values for equities (whereby fund assets are calculated using the smoothed value of assets over five years)<br />

and market values for fixed income securities, as at the measurement date of September 30.<br />

Pension and OPEB expenses are recorded during the year in which employees render services. Pension<br />

and OPEB expenses consist of current service costs, interest expense on liabilities, expected return on<br />

plan assets and the amortization of plan amendments on a straight-line basis over the expected average<br />

remaining service life of the employees covered by the plan. Actuarial gains/(losses) arise from, among<br />

other things, the difference between the actual rate of return on plan assets for a period and the expected<br />

long-term rate of return on plan assets for that period or from changes in actuarial assumptions used to<br />

determine the accrued benefit obligations. The excess, if any, of the cumulative unamortized net actuarial<br />

gain or loss over 10% of the greater of the projected benefit obligation and the market-related value of<br />

plan assets is also amortized over the expected average remaining service life of the employees covered<br />

by the plan.<br />

13

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

The expected average remaining service life of employees covered by the pension and OPEB plans is 11<br />

years (2008 - 11 years).<br />

i) Deferred costs<br />

Deferred costs represent start-up costs incurred by the <strong>IESO</strong> during 2006 for the smart metering<br />

initiative ($1,595,605). In <strong>2009</strong>, the <strong>IESO</strong> adopted CICA Handbook Section 3064, Goodwill and<br />

Intangible Assets which requires these start-up costs to be written off (Note 3).<br />

j) Foreign currency exchange<br />

Transactions denominated in foreign currencies are translated into Canadian dollars at the rate of<br />

exchange prevailing on the date of the transaction. Monetary assets and liabilities denominated in foreign<br />

currencies at the balance sheet date are translated in Canadian dollars at the rate prevailing at that date.<br />

Exchange gains and losses arising on settlement of foreign exchange transactions are reported in the<br />

statement of operations at the date at which the transactions are settled.<br />

k) Use of estimates<br />

The preparation of the financial statements in conformity with Canadian generally accepted accounting<br />

principles requires management to make estimates and assumptions that affect the reported amounts of<br />

revenues, expenses, assets and liabilities and the disclosure of contingent assets and liabilities as at the<br />

date of the financial statements. Actual results could differ from those estimates.<br />

l) Comparative figures<br />

Certain 2008 comparative figures have been reclassified to conform to the <strong>2009</strong> financial statement<br />

presentation.<br />

3. CHANGE IN ACCOUNTING POLICIES<br />

The <strong>IESO</strong> retrospectively adopted Canadian Institute of Chartered Accountants’ (CICA) Handbook<br />

Section 3064, Goodwill and Intangible Assets in <strong>2009</strong>. Upon adoption of the new accounting standard,<br />

the <strong>IESO</strong> reclassified computer applications software previously classified as property and equipment<br />

to intangible assets and expensed start up costs incurred in 2006 previously classified as deferred costs<br />

($1,595,605). The new standard requires the <strong>IESO</strong> to provide new disclosures which are included in Note<br />

5.<br />

The <strong>IESO</strong> adopted EIC 173 and revisions to CICA Handbook Section 3862. No material changes to the<br />

financial statements resulted from these adoptions.<br />

14

ieso <strong>2009</strong> ANNUAL REPORT<br />

4. PROPERTY AND EQUIPMENT<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

Property and equipment in service<br />

Accumulated Net Book Accumulated Net Book<br />

Costs Amortization Value Costs Amortization Value<br />

$ $ $ $ $ $<br />

Facilities 50,087 13,769 36,318 49,782 12,279 37,503<br />

Meter Data Management/<br />

Repository 18,208 5,638 12,570 16,650 2,557 14,093<br />

Market systems and applications 207,861 189,620 18,241 206,771 178,029 28,742<br />

Infrastructure and other assets 75,178 67,451 7,727 73,550 62,307 11,243<br />

351,334 276,478 74,856 346,753 255,172 91,581<br />

Construction-in-progress 4,882 - 4,882 1,781 - 1,781<br />

356,216 276,478 79,738 348,534 255,172 93,362<br />

In <strong>2009</strong>, the impact of adjustments to management’s estimates of remaining asset service lives was a<br />

decrease in amortization expense of $390,533 (2008 - $6,224,713).<br />

Interest capitalized to construction-in-progress during <strong>2009</strong> was $34,574.<br />

5. INTANGIBLE ASSETS<br />

As a result of adopting the new accounting standard Section 3064, Goodwill and Intangible Assets, in<br />

<strong>2009</strong> (Note 3), the <strong>IESO</strong> reclassified $34,205,333 in computer applications software previously classified as<br />

property and equipment to intangible assets.<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

Accumulated Net Book Accumulated Net Book<br />

Costs Amortization Value Costs Amortization Value<br />

$ $ $ $ $ $<br />

Intangible assets 34,205 29,620 4,585 33,048 26,620 6,428<br />

Construction-in-progress 2,100 - 2,100 346 - 346<br />

36,305 29,620 6,685 33,394 26,620 6,774<br />

In <strong>2009</strong>, the impact of adjustments to management’s estimates of remaining asset service lives was a<br />

decrease in amortization expense of $13,043 (2008 - $219,423).<br />

15

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

6. LONG-TERM INVESTMENTS<br />

Long-term investments in a balanced portfolio of pooled funds are valued by the pooled funds manager<br />

based on published price quotations and amount to $17,930,573 (2008 – $14,501,928). As at December 31,<br />

the market value allocation of these long-term investments was 60.9% equity securities and 39.1% debt<br />

securities (2008 – 56.6% and 43.4%respectively).<br />

Balanced portfolio of pooled funds<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

Opening balance 14,502 16,052<br />

Purchase of investments 2,014 1,381<br />

Change in fair value 1,415 (2,931)<br />

Closing balance 17,931 14,502<br />

Long-term investments in non-bank sponsored ABCP are carried at an estimated fair value of $273,513<br />

(2008 - $469,840). Fair value is determined based on estimated discounted cash flows.<br />

In its administration of the <strong>IESO</strong>-Administered Markets, the <strong>IESO</strong> directs the investment of market funds<br />

in highly-rated short-term investments, including previous investments in asset-backed commercial<br />

paper (ABCP), throughout the settlement cycle. The <strong>IESO</strong> is entitled to receive the investment interest<br />

and investment gains, net of investment losses earned on funds passing through the real-time market<br />

settlement accounts. The <strong>IESO</strong> is not entitled to the principal on real-time market investments.<br />

The <strong>IESO</strong> is not obligated to reimburse the market accounts in respect of investment losses incurred<br />

on the investments. As a result of investment losses on existing ABCP investments purchased in 2007,<br />

the accumulated net investment income since 2007 has been negative. Accordingly, the <strong>IESO</strong> has not<br />

recognized as other revenue any investment income earned in the market settlement accounts in 2007,<br />

2008 or <strong>2009</strong>.<br />

7. POST-EMPLOYMENT BENEFIT PLANS<br />

The <strong>IESO</strong> provides pension and other employee post-employment benefits, comprising group life<br />

insurance, long-term disability and group medical and dental plans, for the benefit of current and retired<br />

employees.<br />

Pension plans<br />

The <strong>IESO</strong> provides a contributory defined benefit, indexed, registered pension plan. In addition to the<br />

funded, registered, pension plan, the <strong>IESO</strong> provides certain non-registered defined benefit pensions<br />

through an unfunded, indexed, non-registered plan.<br />

16

ieso <strong>2009</strong> ANNUAL REPORT<br />

Other employee future benefits<br />

The group life insurance, long-term disability and group medical and dental benefits are provided<br />

through unfunded, non-registered defined benefit plans.<br />

Summary of accrued benefit obligations and plan assets<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Pension Pension Other Other<br />

(in thousands of Canadian dollars) Benefits Benefits Benefits Benefits<br />

$ $ $ $<br />

Accrued benefit obligation 396,936 367,356 67,630 60,037<br />

Fair value of plan assets 269,791 264,870 - -<br />

Funded status (127,145) (102,486) (67,630) (60,037)<br />

Employer contribution after measurement<br />

date 2,264 2,154 467 449<br />

Unamortized past service costs 2,323 3,021 172 (8)<br />

Unamortized net actuarial loss 125,907 95,472 15,970 13,080<br />

Prepaid/(accrued) benefit cost recognized<br />

in the statement of financial position<br />

3,349 (1,839) (51,021) (46,516)<br />

Prepaid benefit cost in <strong>2009</strong> is shown net of a valuation allowance of $nil.<br />

Registered pension plan assets<br />

As at the measurement date of September 30, registered pension plan assets were split by fair value<br />

between the following categories:<br />

<strong>2009</strong> 2008<br />

Canadian equity securities 21.0% 21.0%<br />

Foreign equity securities 39.8% 33.0%<br />

Canadian debt securities 37.5% 45.5%<br />

Cash equivalents 0.7% 0.5%<br />

Forward foreign exchange contracts 1.0% 0.0%<br />

100.0% 100.0%<br />

Summary of principal assumptions used to calculate benefit obligations<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Pension Pension Other Other<br />

Benefits Benefits Benefits Benefits<br />

Discount rate at end of the period 5.8% 6.1% 5.8% 6.1%<br />

Rate of compensation increase 4.0% 4.0% 4.0% 4.0%<br />

17

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

The assumed hospital and drug cost increase is 9.0% per annum initially. The rate is assumed to begin<br />

decreasing gradually commencing on October 1, 2010 to a rate of 5.0% in 2018 and remain at that level<br />

thereafter. Dental costs are assumed to increase by 6.0% per annum initially and to begin decreasing<br />

commencing on October 1, 2010 to a rate of 4.5% in 2013 and remain at that level thereafter.<br />

Summary of benefit costs and plan contributions<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Pension Pension Other Other<br />

(in thousands of Canadian dollars) Benefits Benefits Benefits Benefits<br />

$ $ $ $<br />

Benefit cost 12,524 13,456 6,240 6,252<br />

Employer contributions 17,603 8,448 1,717 1,575<br />

Plan participants’ contributions 2,749 2,579 - -<br />

Benefits paid 21,458 16,736 1,717 1,575<br />

The most recent actuarial valuation of the registered pension plan for funding purposes was at January 1,<br />

2008, and the date of the next required valuation is January 1, 2011.<br />

Summary of principal assumptions used to calculate benefit costs<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Pension Pension Other Other<br />

Benefits Benefits Benefits Benefits<br />

Discount rate at the beginning of the period 6.1% 5.4% 6.1% 5.4%<br />

Expected return on plan assets 6.75% 7.0% - -<br />

Rate of compensation increase 4.0% 3.5% 4.0% 3.5%<br />

Rate of indexing of pension benefits 2.5% 2.5% - -<br />

8. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

Relating to property and equipment 2,994 4,274<br />

Relating to intangibles 242 265<br />

Relating to operations 16,837 17,633<br />

20,073 22,172<br />

18

ieso <strong>2009</strong> ANNUAL REPORT<br />

9. DEBT<br />

Note payable to OEFC<br />

The note payable to Ontario <strong>Electricity</strong> Financial Corporation (OEFC) due May 1, <strong>2009</strong> was repaid on May<br />

1, <strong>2009</strong>.<br />

In April <strong>2009</strong>, the <strong>IESO</strong> executed a new note payable with OEFC in the amount of $78.2 million. The note<br />

payable to OEFC is unsecured, bears interest at a per annum rate equal to the yield earned on 90 day<br />

Province of Ontario treasury bills on the quarterly reset date plus 25 basis points and is repayable in full<br />

on May 1, 2011. Interest accrues daily and is payable in arrears quarterly in February, May, August and<br />

November of each year. The fair value of the note payable approximates the carrying value.<br />

Credit facility<br />

On April 30, <strong>2009</strong>, the existing credit facility with a Canadian chartered bank expired and the <strong>IESO</strong><br />

entered into a revised agreement with the same Canadian chartered bank. Under the terms of the new<br />

unsecured credit facility, the bank will make available to the <strong>IESO</strong> an amount up to $60 million. The<br />

credit facility expires on April 30, 2010. Advances under this facility are available in Canadian dollars<br />

by way of prime rate loan plus 75 basis points or the issuance of Bankers’ Acceptances at market rates<br />

plus a stamping fee of 175 basis points per annum. Unused portions of this credit facility are subject to<br />

a commitment fee of 45 basis points per annum. As at December 31, <strong>2009</strong>, $nil was drawn on the credit<br />

facility.<br />

10. CAPITAL DISCLOSURES<br />

The <strong>IESO</strong>’s primary objectives are to maintain and enhance the reliability of Ontario’s power system,<br />

administer the wholesale electricity market, and serve the needs of our participants and stakeholders.<br />

In order to fulfill its mandate, the <strong>IESO</strong> receives fees from market participants (Note 1). The <strong>IESO</strong> has a<br />

limited ability to accumulate a surplus from these fees (Note 11).<br />

On March 31, <strong>2009</strong>, the Ontario Energy Board (OEB) issued its order approving the <strong>IESO</strong>’s application<br />

fee of $1,000, the usage fee of $0.822/MWh and the <strong>IESO</strong>’s revenue requirements in the amount of $130.3<br />

million and capital expenditures in the amount of $22.9 million.<br />

The <strong>IESO</strong> submitted the proposed 2010 expenditures, revenue requirements, and fees to the OEB for<br />

review on November 2, <strong>2009</strong> after deemed approval by the Minister. The Minister provided formal<br />

approval of <strong>IESO</strong>’s proposed expenditures, revenue requirements and fees on November 16, <strong>2009</strong>. To<br />

date, the OEB has not approved the <strong>IESO</strong>’s proposed usage fee for 2010.<br />

In addition, the <strong>IESO</strong> maintains a credit facility for short-term funding to support its various capital<br />

requirements. The <strong>IESO</strong> has customary covenants associated with the credit facility and is in compliance<br />

with all of these covenants.<br />

19

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

11. ACCUMULATED DEFICIT AND REBATES TO MARKET PARTICIPANTS<br />

In <strong>2009</strong>, the <strong>IESO</strong> recognized $4,323,840 in rebates to market participants of system fees (2008 –<br />

$1,386,144), due to a net operating surplus in the year. The <strong>IESO</strong>’s approved regulatory deferral<br />

account balance is maintained at a maximum of $5 million. As at December 31, the components of the<br />

accumulated defict were as follows:<br />

Accumulated deficit<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

Approved regulatory deferral account (a) 5,000 5,000<br />

Accumulated market penalties and fines (b) 1,372 1,832<br />

Smart metering entity - accumulated deficit(c) (25,897) (12,443)<br />

(19,525) (5,611)<br />

a) Approved regulatory deferral account<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

Accumulated surplus - beginning of year 5,000 691<br />

Revenues (before rebates to market<br />

participants)<br />

125,770 135,692<br />

Rebates to market participants (4,324) (1,386)<br />

Expenses (99,849) (101,331)<br />

Amortization (21,239) (20,803)<br />

Net interest (358) (7,863)<br />

Accumulated surplus - end of year 5,000 5,000<br />

b) Accumulated market penalties and fines<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

$ $<br />

Accumulated surplus - beginning of year 1,832 2,476<br />

Revenue from penalties and fines 53 77<br />

Customer education expenses (513) (721)<br />

Accumulated surplus - end of year 1,372 1,832<br />

20

ieso <strong>2009</strong> ANNUAL REPORT<br />

c) Smart metering entity - accumulated deficit<br />

As at December 31<br />

(in thousands of Canadian dollars) <strong>2009</strong> 2008<br />

Opening accumulated deficit (before change in<br />

accounting policy)<br />

$ $<br />

- (124)<br />

Change in accounting policy - (1,596)<br />

Accumulated deficit - beginning of year (12,443) (1,720)<br />

Smart metering program costs (9,962) (7,763)<br />

Smart metering amortization (3,080) (2,557)<br />

Smart metering interest expense (412) (403)<br />

Accumulated deficit - end of year (25,897) (12,443)<br />

In his approval letter to proceed to the OEB for approval of the <strong>2009</strong> usage fee, the Minister noted the<br />

intention of the <strong>IESO</strong> to apply to the OEB separately for a smart meter service fee with respect to the costs<br />

the <strong>IESO</strong> has incurred on the smart metering initiative. At that time, the Minister requested, prior to the<br />

<strong>IESO</strong> filing an application to the OEB in respect of a smart meter service fee, the <strong>IESO</strong> provide him with<br />

a detailed implementation plan, and schedule for the integration of the local distribution companies, to<br />

enable a broader transition to time-of-use pricing for electricity consumers. The <strong>IESO</strong> has since provided a<br />

plan to the Minister and received approval to proceed with an application before the OEB. The permanent<br />

licence and fee applications to the OEB are in the course of preparation. It is the <strong>IESO</strong>’s intent, consistent<br />

with the <strong>Electricity</strong> Act, 1998 to recover all costs, including capital costs and/or accumulated deficits<br />

associated with the smart meter entity through a smart meter service fee once approved.<br />

The <strong>IESO</strong>’s smart meter service fees as of December 31, <strong>2009</strong> have not yet been established.<br />

12. FINANCIAL RISK MANAGEMENT<br />

The <strong>IESO</strong> is exposed to financial risks in the normal course of its business operations, including market<br />

risks resulting from volatilities in equity, debt, and foreign currency exchange markets, as well as credit<br />

risk and liquidity risk. The nature of the financial risks and the <strong>IESO</strong>’s strategy for managing these risks<br />

has not changed significantly from the prior year.<br />

a) Market Risk<br />

Market risk refers to the risk that the fair value or future cash flows of a financial instrument will fluctuate<br />

to cause changes in market prices. The <strong>IESO</strong> is exposed to three types of market risk: currency risk,<br />

interest rate risk and equity risk. The <strong>IESO</strong> monitors its exposure to market risk fluctuations and may use<br />

financial instruments to manage these risks as it considers appropriate. The <strong>IESO</strong> does not use derivative<br />

instruments for trading or speculative purposes.<br />

21

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

i) Currency Risk<br />

The <strong>IESO</strong> conducts certain transactions in US dollars, primarily related to vendor<br />

payments, and maintains a US dollar denominated bank account. From time to time, the<br />

<strong>IESO</strong> uses currency forward purchase contracts to purchase foreign currencies for delivery<br />

at a specified date in the future at a fixed exchange rate. In addition, the <strong>IESO</strong> invests in<br />

pooled funds with US dollar and other foreign currency denominated investments. The<br />

reasonably possible currency risks associated with these exposures were not material as at<br />

December 31, <strong>2009</strong>.<br />

ii) Interest Rate Risk<br />

The <strong>IESO</strong> is exposed to changes in interest rates primarily through its variable rate credit<br />

facility, cash equivalents, and long-term investments. Long-term investments include<br />

investments in a pooled Canadian bond fund. The reasonably possible interest rate risks<br />

associated with these exposures were not material as at December 31, <strong>2009</strong>.<br />

iii) Equity Risk<br />

The <strong>IESO</strong> is exposed to changes in equity prices through its long-term investments.<br />

Long-term investments include investments in pooled equity funds. A 30% change in the<br />

value of equities in the <strong>IESO</strong>’s pooled fund investments as at December 31, <strong>2009</strong> would<br />

have resulted in a change for the year (before the impact of adjustments to the approved<br />

regulatory deferral account (Note 11)) of approximately $3.3 million (2008 - $2.5 million).<br />

Financial instruments at fair value<br />

As at December 31<br />

(in thousands of Canadian dollars) Level 1 Level 2 Level 3 Total<br />

$ $ $ $<br />

Cash and cash equivalents 8,990 - - 8,990<br />

Investment in pooled funds 17,931 - - 17,931<br />

non-bank ABCP - - 273 273<br />

26,921 - 273 27,194<br />

b) Credit Risk<br />

Credit risk refers to the risk that one party to a financial instrument may cause a financial loss for the<br />

other party by failing to meet its obligations under the terms of the financial instrument. The <strong>IESO</strong><br />

is exposed directly to credit risk related to cash equivalents and accounts receivable and indirectly<br />

through its exposure to bond investments in pooled funds. Direct exposure to credit risk is limited to<br />

the carrying amount presented for these assets on the statement of financial position. The <strong>IESO</strong> manages<br />

credit risk associated with cash equivalents (which amounted to $9 million as at December 31, <strong>2009</strong>)<br />

through approved management policy which limits investments to investment grade investments with<br />

counterparty-specific limits of no more than $20 million. Accounts receivable as at December 31, <strong>2009</strong><br />

included no material items past due and substantially all of the balance was collected as at January<br />

21, 2010. As at December 31, <strong>2009</strong>, the Canadian bond fund in which the <strong>IESO</strong> invests comprised of<br />

investment grade securities rated BBB(low), or better.<br />

22

ieso <strong>2009</strong> ANNUAL REPORT<br />

c) Liquidity Risk<br />

Liquidity risk refers to the risk that the <strong>IESO</strong> will encounter financial difficulty in meeting obligations<br />

associated with its financial liabilities. The <strong>IESO</strong> manages liquidity risk by forecasting cash flows to<br />

identify financing requirements. Cash flows from operations and investment income and maintaining<br />

appropriate credit facilities reduce liquidity risk. The <strong>IESO</strong>’s long-term investments in pooled funds are<br />

normally able to be redeemed within three business days however, the manager of the pooled funds has<br />

the authority to require a redemption in-kind rather than cash and has the ability to suspend redemptions<br />

if deemed necessary.<br />

13. COMMITMENTS AND CONTINGENCIES<br />

Operating commitments<br />

The obligations of the <strong>IESO</strong> with respect to non-cancellable operating leases over the next three years are<br />

as follows:<br />

As at December 31 (in thousands of Canadian dollars) <strong>2009</strong><br />

$<br />

2010 2,146<br />

2011 1,590<br />

2012 66<br />

Contingencies<br />

The <strong>IESO</strong> is subject to various claims, legal actions, and investigations that arise in the normal course<br />

of business. While the final outcome of such matters cannot be predicted with certainty, management<br />

believes that the resolution of such claims, actions and investigations will not have a material impact on<br />

the <strong>IESO</strong>’s financial position or results of operations.<br />

23

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Appendix A - <strong>IESO</strong> Organizational Charts<br />

James Hinds<br />

Chair<br />

Board of Directors<br />

Rudy Riedl<br />

Chair<br />

Human Resources & Governance Committee<br />

William Museler<br />

Chair<br />

Audit Committee<br />

Roberta Brown<br />

Director<br />

Paul Murphy<br />

Director<br />

President & Chief Executive Officer<br />

Board of Directors<br />

David Cassivi<br />

Director<br />

Helen Polatajko<br />

Director<br />

Angela Ferrante<br />

Director<br />

Howard Shearer<br />

Director<br />

Vacant<br />

Director<br />

John Wiersma<br />

Director<br />

Paul Murphy<br />

President & Chief Executive Officer<br />

Bruce Campbell<br />

Vice President<br />

Resource Integration<br />

Bill Limbrick<br />

Vice President<br />

Organizational Development<br />

Chief Information Officer<br />

Senior Management Team<br />

Ken Kozlik<br />

Vice President<br />

Operations<br />

Chief Operating Officer<br />

Terry Young<br />

Vice President<br />

Corporate Relations<br />

Ted Leonard<br />

Vice President<br />

Finance<br />

Chief Financial Officer & Treasurer<br />

Don Tench<br />

Director<br />

Market Assessment & Compliance<br />

Roy Stewart<br />

General Counsel & Corporate Secretary<br />

24

ieso <strong>2009</strong> ANNUAL REPORT<br />

Appendix B - Executive Compensation<br />

Program Objectives<br />

The <strong>IESO</strong> compensation program is an integrated program for all management group staff, designed to<br />

attract, retain and motivate the calibre of executives required to support the achievement of our statutory<br />

mandate, business objectives and corporate vision. Accordingly, the compensation philosophy and<br />

programs have been built on the following objectives:<br />

• To focus executives on meeting the <strong>IESO</strong>’s business objectives<br />

• To attract qualified and talented staff needed to carry out the <strong>IESO</strong>’s mandate<br />

• To be able to retain valued staff<br />

• To have the flexibility to reward results and demonstrated competencies<br />

• To have compensation levels which are responsible and defensible to stakeholders and customers<br />

The philosophy underlying these objectives is that total compensation for senior management should be<br />

sufficient, but not overly sufficient, to attract and retain the skills and competencies necessary to carry out<br />

the <strong>IESO</strong>’s mandate.<br />

Program Governance<br />

The <strong>IESO</strong> Board of Directors (the Board) establishes the compensation objectives for these programs. They<br />

delegate the responsibility to thoroughly review the compensation objectives, policies and programs to<br />

the Human Resources and Governance Committee of the Board (HRGC) which makes recommendations<br />

concerning such to the full Board for approval. The Board is composed of ten independent, external<br />

Directors, appointed by the Minister of Energy & Infrastructure, with broad experience in both industry<br />

and public sector organizations, plus the Chief Executive Officer. In carrying out their mandate the<br />

Board members have access to Management’s perspectives as well as those of expert consultants in the<br />

compensation field (including experts at various times from Towers Watson, Mercer and Hay). These<br />

programs are reviewed at least annually including business needs, program objectives and design,<br />

industry compensation trends, internal compensation relativities, and external market relativities.<br />

In addition to the formal governance and oversight structure in place for compensation matters, the<br />

<strong>IESO</strong> annually discloses compensation levels for staff earning $100,000 or more as part of the public<br />

sector salary disclosure. For the <strong>IESO</strong>, a further level of public review and assurance is provided through<br />

a statutory required annual fee review. Compensation matters, including management compensation<br />

and market relativities, are addressed during the Ontario Energy Board review. A broad range of small<br />

and large consumers, assisted by their legal and professional advisors, are represented in these public<br />

proceedings. The <strong>IESO</strong> is also responsive to various requests by the Ministry of Energy & Infrastructure<br />

in relation to compensation enquiries such as the Agency Review Panel (ARP) in 2007 which conducted<br />

an exhaustive review of senior management compensation for the various agencies in the Ontario<br />

electricity sector.<br />

25

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

Market Comparisons<br />

The <strong>IESO</strong> regularly benchmarks compensation to similar positions in Canadian industry. The comparator<br />

employers are segmented into government and non-government categories. Market compensation data is<br />

gathered for each segment. A 50/50 weighting is applied to each of the government and non-government<br />

market results to reflect an overall comparator market for executive compensation at the <strong>IESO</strong>. When<br />

comparing the compensation of the <strong>IESO</strong> executives to this overall market, care is taken to assess<br />

positions of similar size, scope and complexity.<br />

The comparator employers include fifteen mid-size to smaller Canadian energy sector companies – seven<br />

government and eight non-government. The list of comparators is outlined below:<br />

Government Comparators<br />

Non-Government Comparators<br />

• Alberta Electric <strong>System</strong> <strong>Operator</strong><br />

• Alliance Pipeline Ltd.<br />

• Atomic Energy of Canada Limited<br />

• ATCO Ltd. & Canadian Utilities Limited*<br />

• Enmax Corporation<br />

• Bruce Power<br />

• EPCOR*<br />

• Emera Inc.<br />

• New Brunswick Power Corporation<br />

• FortisAlberta<br />

• Newfoundland & Labrador Hydro Electric Corporation • Kinder Morgan Canada Inc. (Pipelines)<br />

• Saskatchewan Power Corporation<br />

• Spectra Energy Transmission*<br />

• TransAlta Corporation*<br />

*For these larger organizations a full level downward adjustment has been made for compensation comparison purposes (e.g. the <strong>IESO</strong> CEO level<br />

is compared to the SVP/EVP level for the external firm).<br />

While market data is gathered for various components of compensation, emphasis is placed on total<br />

rewards including the sum of fixed and variable compensation, benefits and pension. Thus, total rewards<br />

for <strong>IESO</strong> executives are benchmarked to the 50th percentile or midpoint of total rewards reported in the<br />

market data.<br />

This approach includes gathering market data on executive compensation, segmenting and weighting<br />

government and non-government market data, and focusing on comparisons at the total rewards<br />

level. The <strong>IESO</strong> undertook such a benchmarking study in 2008. The results indicated that the <strong>IESO</strong>’s<br />

total rewards for the Management Group overall were at the median of this market. In addition to the<br />

comparisons outlined above, the <strong>IESO</strong> Board also reviews available compensation data for other North<br />

American <strong>Independent</strong> <strong>System</strong> <strong>Operator</strong>s to determine if broader North American trends should be<br />

considered.<br />

Program Description - Roles<br />

The <strong>IESO</strong>’s program includes fixed and variable compensation, core and flex benefit plans, and pension<br />

provisions. <strong>IESO</strong> Human Resources staff participates in and reviews results from various compensation<br />

surveys and monitors economic trends such as compensation trends, inflation and unemployment<br />

rates which impact on compensation, as well as monitoring internal compensation relativities. Based<br />

on this data and the <strong>IESO</strong> business priorities, Human Resources staff develops recommendations<br />

26

ieso <strong>2009</strong> ANNUAL REPORT<br />

on compensation programs for all Management staff. External specialized compensation, benefit<br />

and pension consultants are utilized to ensure accurate, representative market compensation data is<br />

obtained, that current industry compensation trends are being utilized, as well as to provide insight<br />

and recommended adjustments to current programs. An expert, external consultant also reviews the<br />

recommendations as to the reasonableness and appropriateness of Management’s recommendations.<br />

Senior Management reviews the recommendations and provides advice to the CEO who determines<br />

whether the recommendations should be advanced to the HRGC and the <strong>IESO</strong> Board. The Chair of the<br />

HRGC reviews the recommendations and supporting data prior to submission to the HRGC, along with<br />

the input from an expert, external consultant. The Chair determines if additional external expertise is<br />

required. The analysis and conclusions from these external experts are provided to the HRGC members<br />

for their consideration. The HRGC reviews in detail the recommendations, the supporting data and<br />

advice from the expert, external consultant(s) and decides on the recommendations to go to the full<br />

Board. The Board reviews the submissions and makes a final determination on the recommendations.<br />

In <strong>2009</strong> the HRGC decided that an external consultant with management compensation expertise should<br />

be retained by the <strong>IESO</strong> Board to provide a review of the <strong>IESO</strong>’s Management Compensation Program.<br />

The analysis and conclusions from the selected external expert were provided to the HRGC members for<br />

their consideration. As a result some limitations were placed on the flex benefit plan and on the scope<br />

of the variable compensation program. In addition the <strong>IESO</strong> Board approved an in depth review of the<br />

program design and benchmarks be undertaken in 2010 for implementation in 2011.<br />

Program Description - Fixed Compensation<br />

The Board establishes broad salary ranges for each level of executive taking into account comparable<br />

market relativities. Within these bands individuals are assessed as developmental, mature or expert<br />

in their position relative to an established competency model. This model consists of behavioural<br />

competencies, such as customer focus, drive for results, teamwork, leadership, and strategic business<br />

sense. The assessment is based upon demonstrated competency. Each individual is then awarded a fixed<br />

compensation level within their band.<br />

Unfavourable economic conditions were at play in 2008 and <strong>2009</strong> as a result of significant downturns<br />

in the major global economies. The Government of Ontario responded to these conditions by calling<br />

for compensation restraint within the public sector. The <strong>IESO</strong> applied the spirit of the government’s<br />

guidelines by limiting <strong>2009</strong> salary increases for management staff earning $150,000 or more annually<br />

to 1.5% and overall limiting the full Management Group to an increase of 2.1%. This maximum of 1.5%<br />

impacted all Named Executives in the <strong>IESO</strong> disclosure. Furthermore, the <strong>IESO</strong> has generally restricted<br />

salary increases into 2010 for Management Group staff, including executives.<br />

Program Description - Variable Compensation<br />

In order to promote a results orientation in the senior team, the variable pay plan is a significant<br />

component of the total compensation of executives. The CEO’s target for variable compensation for <strong>2009</strong><br />

was at 65% of fixed compensation and the target for Vice Presidents was 50% of fixed compensation. The<br />

plan provides for awards above or below target amounts depending on the performance results achieved.<br />

The <strong>IESO</strong> Board annually establishes a robust set of performance measures which are evaluated each year<br />

and these results carry a 70% weight within each executive’s variable compensation award. The remaining<br />

27

<strong>IESO</strong> <strong>2009</strong> ANNUAL REPORT<br />

30% results from the assessment of predetermined measures/targets established for each individual<br />

executive. To address retention, 50% of the earned variable compensation is deferred and paid out over<br />

a three year period, with accrued but unpaid amounts forfeited in the event of termination with cause or<br />

voluntary resignation.<br />

Program Description - Group Benefits<br />

The group benefit plan provides a core level of health & dental benefits, life insurance, disability coverage<br />

and vacation which can be adjusted by the executives through the flexible component of the plan. The<br />

flexible element provides executives the option of adjusting their benefits to meet their individual/<br />

family needs including vacation above core amounts, levels of life insurance, health coverage and other<br />

components.<br />

Program Description - Pension Plan<br />

A defined benefit pension plan provides annual retirement income calculated as 2% of pensionable<br />

earnings (fixed compensation and one-half of variable compensation paid during the highest paid 36<br />

consecutive months of service) multiplied by years of service, to a maximum of thirty-five years. This<br />

formula provides a maximum benefit of 70% of highest paid, pre-retirement earnings. The Canadian<br />

Revenue Agency limits the amount of pension payable from a registered plan and the <strong>IESO</strong> has a<br />

supplemental employee retirement plan (SERP) to provide pension income above that payable from the<br />

registered plan. Pension plan funding is a combination of employer and employee contributions.<br />

Pension benefits from the plan are designed to provide a level income stream before and after age 65,<br />

when the <strong>IESO</strong> pension is reduced to reflect provisions from the Canada Pension Plan. The plan provides<br />

several benefit options including member’s life only or joint and survivor pensions. As well there are preretirement<br />

death provisions to provide benefits to surviving spouses or beneficiaries.<br />

Performance Measures and Impact on Compensation<br />

The <strong>IESO</strong> annually establishes corporate performance measures relating to its business priorities during<br />

the business planning process. These are approved, monitored and assessed by the <strong>IESO</strong> Board of<br />